Is Your Personal Data Being Sold? A Deep Dive Into Data Brokers

INTRODUCTION: THE HIDDEN DATA ECONOMY

Every single scroll you do in social media, every online search, and every purchase you make are the digital breadcrumbs you leave behind. The very same thing that causes privacy advocates to lose sleep is that the data you've never heard about are being collected, the pieces are being put together into very detailed profiles of you, and eventually, that data is sold to the one who pays the most.

In the world of data brokers, welcome - an industry that is projected to reach almost $434 billion in 2025. Although these shadowy middlemen conduct most of their operations without public knowledge, they nonetheless possess the extremely sensitive data of hundreds of millions of individuals. The question of whether your personal information is being sold or not almost always leads to a "yes" answer, and you probably do not even know how many times or to whom it has been sold.

The data broker market is immense, intricate, and predominantly unnoticed by the average consumer. Yet it has far-reaching consequences for your privacy, safety, and independence. The first step towards regaining control over your personal information is to learn how the industry operates.

WHAT ARE DATA BROKERS?

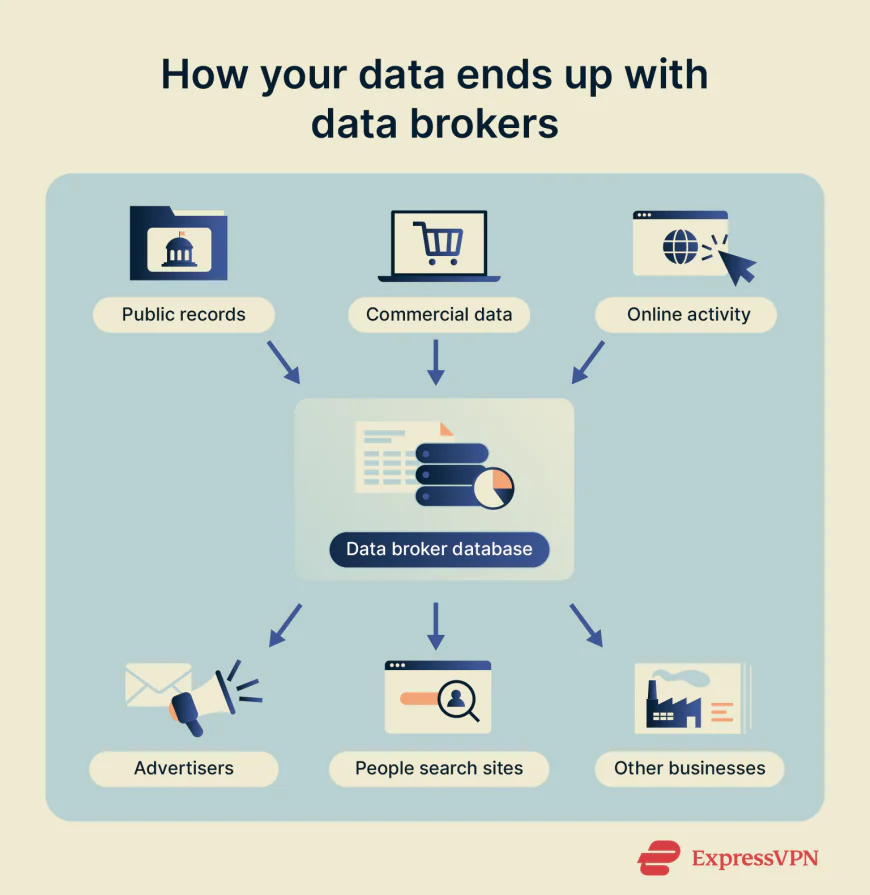

At the very least, data brokers are companies that aggregate, sell and purchase great quantities of personal data. They can be thought of as the wholesalers of information. Though the companies like Amazon or Netflix that you directly do business with do interact with you, data brokers do not normally interact with consumers. They rather operate behind the curtain, gathering data from a multitude of sources and compiling it into characterizations which they then sell to advertisers, marketers, banks, insurance firms, political campaigns, and even law enforcement agencies.

Data brokers could be likened to the digital age's middlemen. The number of data brokering organizations around the globe is approximately 4,000, with the likes of Experian, Equifax, Acxiom, and Epsilon being the most well-known ones. However, this is merely the tip of the iceberg - the vast number of small-scale brokers working quietly in the background, gathering and monetizing data on an enormous scale, is almost beyond reckoning.

The business model is rather simple - the larger the amount of data you possess, the more intricate your profiles are, and thus the higher the worth of your product. Moreover, since most of the data collection has been carried out without your permission, there is very little to prevent them from going on. Data brokers have established a prosperous environment wherein personal data is regarded as a product that can be traded like any other commodity.

HOW DATA BROKERS COLLECT YOUR INFORMATION

Data brokers are really clever in gathering data. They mix various techniques to create detailed files of individuals:

PUBLIC RECORDS: Court records, census, registration of voters, property records and marriage licenses are all data broker’s godsends. These places give such basic information as your birthday, place of living, marital status and political affiliation-all legally allowed to be accessed and distributed.

SOCIAL MEDIA: Data brokers are seeing when your Facebook profile is open, or your LinkedIn shows your job history. Using highly developed web scraping tools, they are savoring all the information that you have shared, no permission needed.

ONLINE TRACKING: Cookies and tracking pixels are your digital ghosts that never leave you as you browse the web. Each time you go to a site, data brokers are aware of what you are viewing, how much time you are spending, and what you are clicking on. This internet usage information is very precious to advertisers.

LOYALTY PROGRAMS: Did you use your grocery store's reward card? You have likely consented to sharing your buying data with outsiders without being fully aware of it. Loyalty schemes are very rich in transaction histories and consumer behavior insights.

DATA PURCHASES AND PARTNERSHIPS: Data brokers are not only those who collect the data; they also sell it to other companies and collaborate to exchange information. This means that you have created a complicated network where your information is being passed all over.

MOBILE APPS AND SUBSCRIPTIONS: Usually free apps and services are the main sources of the user's data. Some apps reveal this data to third parties openly, while others resort to techniques like app scraping to extract information without clear consent.

WHAT INFORMATION DO THEY GATHER?

Brokers' data collection is so extensive that it cannot be imagined even in a dream. You can consider the following as the standard data they've collected about you:

IDENTITY AND CONTACT INFORMATION: Your complete name, nicknames, date of birth, mobile number, email addresses, present and past residences, and possibly your Social Security number.

DEMOGRAPHICS: Age, sex, culture, marital status, education, job, and income.

FINANCIAL DATA: Ranges of credit scores, past bankruptcies, and settlements of debts and ownership of assets.

BEHAVIORAL DATA: Your internet browsing, search, social networking, online shopping, and ads clicking activity.

HEALTH INFORMATION: Information on non-HIPAA protected access, for example, health supplements you bought and your online research of health conditions.

LOCATION DATA: Mobile phones and wearables help data brokers monitor not only your real-time location but also your movement patterns.

INTERESTS AND AFFILIATIONS: Your political views, favorite leisure activities, and even religious beliefs inferred from your online activity.

PURCHASE HISTORY: Information about not only what you purchased but also when, where, and how much you spent.

The level of detail is so invasive that brokers know your fitness interest, for instance; they can even tell that you have a certain dietary restriction, have lately looked up a medical condition or have been to a certain hospital. The data they collect are very thorough and frighteningly accurate.

WHO BUYS YOUR DATA?

The buyers of your data are an unexpectedly extensive group:

ADVERTISERS AND MARKETERS are the major players in the data broker market. They utilize your profile to present you ads that are very much in your target market according to your demographics, interests, and behavior patterns. The aim is really straightforward: to hand you ads about the things that you are very likely to buy.

INSURANCE COMPANIES go for data to determine the risk for the particular insured or the insured group. They could consider your health research, data of your residence, or your lifestyle as factors to decide if they would take the risk of insuring you and at what rate.

FINANCIAL INSTITUTIONS are data purchasers, and they use data for the assessment of applications for loans. If you are applying for a credit card or mortgage, lenders may call for data from brokers to make a judgment about your creditworthiness.

POLITICAL CAMPAIGNS buy detailed consumer profiles to customize political messaging. They wish to know your values, worries, and voting patterns so that they can direct the right ads and messages - those that will click with you - and thus their campaign will be more effective.

EMPLOYERS AND LANDLORDS perform background checks relying on data broker information. When you apply for a job or rental, they may check your data profile to judge your trustworthiness.

LAW ENFORCEMENT AND GOVERNMENT AGENCIES obtain data from brokers via contracts. Investigations can take advantage of the purchase of location data, communication metadata, and social media activity as evidence.

OTHER DATA BROKERS exchange information among themselves, thus increasing the number of companies that can access your data. This effect of multiplication means that your information is distributed pretty far beyond what you might foresee.

THE REAL RISKS YOU FACE

Though personalized marketing might just be an annoyance, the data brokers’ actual risks are really big:

IDENTITY THEFT AND FRAUD: Data brokers possess the all-important details that thieves are after to impersonate you or trick you. Social Security numbers, addresses, and credit card numbers are just some of the data they store, which all become a single point of failure. The security of personal data has already been breached on a large scale: in 2024, a data theft incident at the National Public Database made more than 170 million people vulnerable to identity theft by exposing their SSNs and emails. Only in 2025, there were three big breaches: 4.4 million people affected at TransUnion and 364,000 at LexisNexis.

PRIVACY INVASION AND STALKING: Uncovering your address and phone number through people search sites makes you at risk of stalking and harassment. Recently, the data brokers have attracted a lot of criticism from domestic abuse survivors who are afraid of being traced by their abusers due to the availability of their information.

TARGETED MANIPULATION: Data brokers are behind the scenes of sophisticated profiling and this can be used to influence your choice of action. Advertisers will be targeting you in your most vulnerable moments, banks will deny you credit referring to negative data broker profiles, and insurers will charge you more due to calculated health risks.

SURVEILLANCE: The government and the police can track your every move, see where you have been and with whom just by using data that the broker provided. It does not matter if you are innocent; being monitored is always intrusive.

DISCRIMINATION: Data brokers are behind the scenes of discriminated algorithms in housing, employment, insurance, and lending. The data used to construct these profiles can reflect past biases that unfairly disadvantage certain groups.

REGULATIONS: WHAT'S CHANGING?

Privacy regulations are slowly but steadily getting to the data broker industry, albeit in an uneven manner:

CALIFORNIA'S LEADERSHIP: California has taken the boldest step in the regulation of data brokers with its Consumer Privacy Act (CCPA) and the Delete Act. Starting on January 31, 2026, California's Privacy Protection Agency (CPPA) will be the registry for data brokers who will be required to divulge their data collection practices and their sale of data. In addition to this, amendments (SB 361) have been passed that broaden the scope of the requirement in terms of disclosure that includes whether or not data brokers have sold to foreign adversaries, AI developers, or police.

THE DELETE REQUEST PLATFORM: The state of California is introducing a "one-stop" shop deletion mechanism where residents can file a single request for their data to be removed from all the data brokers that are registered with the state. Data brokers have a time frame of 45 days to act on these requests.

ONGOING AUDITS: The regulations from the state of California will require auditing of data broker compliance every three years by an independent auditor starting in 2028. This is a safeguard that ensures that the brokers do not just resort to paying fines as a cost of doing business instead of complying with the regulations.

FEDERAL GAPS: The situation for data brokers in the United States is that in the states where privacy laws are not yet in place, they are allowed to operate with almost no federal oversight. The Federal Trade Commission can intervene to some extent, but a complete federal regulation of data brokers is still not a reality.

GLOBAL VARIATION: The requirements specified under GDPR in Europe regarding consent and data use are stricter than those in the US, but still, the data brokers in Europe have somehow been able to adjust their practices accordingly. Other countries are at different levels of protection, but the US still has a long way to go before it can compare with Europe in terms of privacy regulations.

HOW TO PROTECT YOURSELF

Regulations are definitely getting better, but still, it's not a good idea to depend solely on them. Below are the data protection steps that are easy to follow:

MANUAL OPT-OUTS: Look up your data on the main data broker websites like BeenVerified, Acxiom, and People Search. Most of them provide procedures to opt-out-find links such as "Delete Your Information" or "Privacy Requests." You may need to share some personal information and then wait up to 45 days for your request to be processed. Document your actions.

AUTOMATED REMOVAL SERVICES: Companies such as DeleteMe, Aura, and Malwarebytes offer automated data removal services that do all the contacting of data brokers for you. These kinds of services come with a cost, but the time saving and delivery of continuous monitoring are considerable.

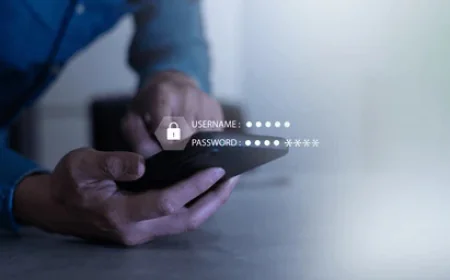

FREEZE YOUR CREDIT: The placing of a freeze on your credit should be done by contacting the three major credit reporting agencies (Equifax, Experian, and TransUnion). This will make it impossible for anyone to open accounts under your name without your knowledge.

JOIN OPT-OUT LISTS: Sign up with the National Do Not Call Registry, DMAchoice (for direct mail marketing), and OptOutPrescreen.com to cut back on unwanted communications and restrict the flow of personal data.

ADJUST YOUR DIGITAL FOOTPRINT: Change your social media accounts to private, turn off your phone's location tracking, and switch off third-party data sharing in application settings. The less data you choose to disseminate, the less data there is for collecting.

USE PRIVACY TOOLS: Make use of a password manager, a VPN, and perhaps consider using privacy-centric browsers and search engines to ensure a smaller digital footprint.

MONITOR YOUR INFORMATION: Take advantage of credit monitoring services and alert Google with your name to be informed when your information is found in unusual places.

Though these steps will not totally get rid of the problem they will, however, greatly minimize your exposure and make it harder for brokers to monetize your data.

CONCLUSION

The uneasy reality is that nearly certainly your personal information is being sold right now. Monetization of knowledge on who you are, what you desire, and what you do has led data brokers to build a large, mostly unregulated ecosystem. Treating your privacy as a commodity produces hundreds of billions of dollars a year for the industry.

Change begins with knowledge, albeit. While you cannot regulate data brokers completely, you may take action to remove your data from their databases, restrict the kind of new information they gather, and lobby lawmakers for stricter rules.

Though California's rules are slowly catching up, genuine change demands ongoing pressure from consumers and advocates. Until data brokers suffer actual penalties for careless data management, you must safeguard yourself.

Start immediately: Search on a data broker site for your information, submit an opt-out request, and become part of the increasing movement of individuals reclaiming control over their personal information. Effort is well worth your privacy.

One of the most defining problems of our day is the struggle over personal information. You start to be part of the solution by knowing how data brokers operate and taking actual actions to safeguard yourself. Your information is yours; now is the time to start behaving accordingly. x