Blockchain Fundamentals: From Bitcoin to Smart Contracts and Beyond

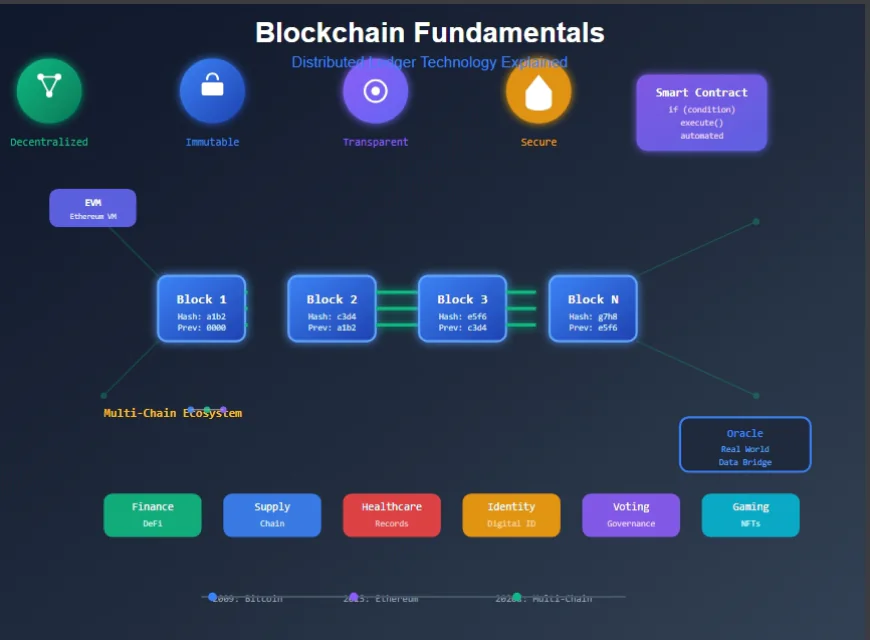

Master blockchain technology from the ground up: understand distributed ledgers, consensus mechanisms, and cryptographic principles; trace blockchain's evolution from Bitcoin to Ethereum; explore real-world applications across finance, supply chain, and healthcare; learn about multi-chain ecosystems, the oracle problem, Chainlink solutions, smart contracts, and the Ethereum Virtual Machine (EVM).

Blockchain technology has evolved from a niche cryptocurrency experiment into a fundamental infrastructure layer reshaping finance, supply chains, healthcare, and digital identity systems. Yet despite its growing importance, blockchain remains widely misunderstood. This comprehensive guide breaks down blockchain fundamentals—from basic concepts to advanced topics like smart contracts, the Ethereum Virtual Machine, and the oracle problem—providing the foundation needed to understand this transformative technology.

Blockchain Basics: Understanding the Foundation

What Is a Blockchain?

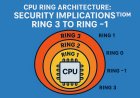

At its core, a blockchain is a distributed, immutable ledger that records transactions across a network of computers. Think of it as a digital record book that:

- Distributed: Copies exist across thousands of computers (nodes)

- Immutable: Once written, data cannot be altered or deleted

- Transparent: All participants can view the entire transaction history

- Secure: Cryptographic techniques protect data integrity

The Fundamental Structure:

A blockchain consists of "blocks" of data "chained" together chronologically:

Block 1 → Block 2 → Block 3 → Block 4 → ...

Each block contains:

- Transaction data: Records of transfers, contracts, or other operations

- Timestamp: When the block was created

- Hash: A unique cryptographic fingerprint of the block's contents

- Previous hash: The hash of the preceding block (creating the "chain")

How Blockchain Works: The Process

Step 1: Transaction Initiation Alice wants to send 1 Bitcoin to Bob. She broadcasts this transaction to the network.

Step 2: Network Validation Thousands of nodes receive and verify the transaction:

- Does Alice have 1 Bitcoin to send?

- Is the transaction properly signed with Alice's private key?

- Are there any double-spending attempts?

Step 3: Block Creation Valid transactions are bundled into a new block by miners (in Proof of Work) or validators (in Proof of Stake).

Step 4: Consensus The network agrees on which block becomes the next addition to the chain through consensus mechanisms like:

- Proof of Work (PoW): Miners solve complex mathematical puzzles

- Proof of Stake (PoS): Validators are chosen based on staked cryptocurrency

Step 5: Block Addition The validated block is added to the chain, and all nodes update their copies of the ledger.

Step 6: Completion Bob receives his Bitcoin. The transaction is now permanently recorded and virtually impossible to reverse.

Core Blockchain Principles

1. Decentralization No central authority controls the network. Power is distributed across all participants.

2. Transparency All transactions are publicly visible, though participants can remain pseudonymous.

3. Immutability Changing historical data requires overwhelming computational power, making tampering impractical.

4. Consensus Network participants must agree on the current state of the ledger through established rules.

Cryptographic Foundations

Public-Key Cryptography:

- Public Key: Like a bank account number—shareable with anyone

- Private Key: Like a password—must remain secret

Hashing: SHA-256 creates a unique "fingerprint" for data:

Input: "Hello World"

Hash: a591a6d40bf420404a011733cfb7b190d62c65bf0bcda32b57b277d9ad9f146e

Even tiny changes produce completely different hashes:

Input: "Hello World!"

Hash: 7f83b1657ff1fc53b92dc18148a1d65dfc2d4b1fa3d677284addd200126d9069

History of Blockchain: From Concept to Revolution

The Pre-Bitcoin Era (1991-2008)

1991: The First Blockchain Concept Stuart Haber and W. Scott Stornetta describe a cryptographically secured chain of blocks—the fundamental blockchain structure—in their paper on timestamping digital documents.

1992: Merkle Trees Integrated The duo incorporates Merkle trees, allowing multiple documents to be collected into one block, improving efficiency.

1998: Bit Gold Computer scientist Nick Szabo proposes "Bit Gold," a decentralized digital currency that prefigures Bitcoin's design. However, it was never implemented.

2004: Reusable Proof of Work Hal Finney introduces reusable proof of work (RPoW), allowing digital tokens to be transferred between individuals.

The Bitcoin Revolution (2008-2013)

October 31, 2008: The Bitcoin Whitepaper An anonymous person or group using the pseudonym Satoshi Nakamoto publishes "Bitcoin: A Peer-to-Peer Electronic Cash System."

Key Innovations:

- Solves the double-spending problem without trusted third parties

- Introduces Proof of Work consensus mechanism

- Creates the first practical cryptocurrency

January 3, 2009: Genesis Block Satoshi mines the first Bitcoin block (Block 0), containing the message: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks"—a commentary on the 2008 financial crisis.

January 12, 2009: First Transaction Satoshi sends 10 BTC to Hal Finney, marking the first peer-to-peer Bitcoin transaction.

May 22, 2010: Bitcoin Pizza Day Laszlo Hanyecz purchases two pizzas for 10,000 BTC (worth approximately $41 at the time), marking the first real-world Bitcoin transaction.

The Ethereum Era (2013-Present)

2013: Vitalik Buterin's Vision 19-year-old programmer Vitalik Buterin proposes Ethereum, recognizing that blockchain technology could do more than just handle currency transactions.

July 30, 2015: Ethereum Launch The Ethereum network goes live, introducing:

- Smart contracts: Self-executing code stored on the blockchain

- Ethereum Virtual Machine (EVM): A decentralized computing platform

- Turing-complete programming: Unlimited computational possibilities

2017: ICO Boom Initial Coin Offerings raise billions for new blockchain projects, demonstrating blockchain's potential beyond Bitcoin.

2020: DeFi Summer Decentralized Finance (DeFi) applications explode in popularity, offering lending, borrowing, and trading without traditional financial institutions.

September 15, 2022: The Merge Ethereum transitions from Proof of Work to Proof of Stake, reducing energy consumption by ~99.95%.

2023-2025: Enterprise Adoption Major corporations and governments implement blockchain for supply chain management, digital identity, and central bank digital currencies (CBDCs).

Benefits of Blockchain Technology

1. Decentralization and Censorship Resistance

Traditional System:

- Central authority controls data and access

- Single point of failure

- Vulnerable to censorship

Blockchain:

- No single entity controls the network

- Operates even if individual nodes fail

- Resistant to censorship and shutdowns

Real-World Impact: Citizens in countries with authoritarian governments can access financial services and information without government interference.

2. Transparency and Auditability

Every transaction is publicly recorded and permanently stored, enabling:

- Real-time auditing: No need to wait for quarterly reports

- Fraud detection: Unusual patterns are immediately visible

- Regulatory compliance: Automated verification of rules

Example: Supply chain transparency allows consumers to verify product authenticity and ethical sourcing from manufacturer to retail.

3. Security and Immutability

Cryptographic Protection:

- Each block is cryptographically linked to the previous one

- Altering historical data requires changing all subsequent blocks

- The network would reject tampered chains

Practical Security: Bitcoin's network has never been successfully hacked. The only successful attacks target exchanges and wallets, not the blockchain itself.

4. Reduced Intermediaries and Costs

Traditional Transaction: Alice → Bank → SWIFT Network → International Correspondent Banks → Bob's Bank → Bob (3-5 days, fees: 5-10%)

Blockchain Transaction: Alice → Blockchain Network → Bob (Minutes to hours, fees: <1%)

Cost Savings:

- Eliminates middlemen

- Reduces transaction fees

- Accelerates settlement times

- Available 24/7/365

5. Programmability and Automation

Smart contracts enable:

- Automatic execution when conditions are met

- Reduced human error

- Elimination of manual processing

- Complex multi-party agreements

6. Enhanced Privacy Options

While blockchains are transparent, privacy-focused designs offer:

- Pseudonymity: Addresses don't directly reveal identities

- Zero-knowledge proofs: Prove facts without revealing data

- Privacy coins: Enhanced transaction privacy (Monero, Zcash)

Blockchain Use Cases: Transforming Industries

1. Finance and Banking

Cryptocurrencies:

- Bitcoin: Digital gold and store of value

- Stablecoins: Price-stable digital currencies (USDC, USDT)

- CBDCs: Government-issued digital currencies

DeFi (Decentralized Finance):

- Lending/Borrowing: Aave, Compound allow peer-to-peer lending

- Decentralized Exchanges: Uniswap, SushiSwap enable direct token trading

- Yield Farming: Earn interest by providing liquidity

Cross-Border Payments: Traditional: 3-5 days, 5-10% fees Blockchain: Minutes to hours, <1% fees

Real Example: Ripple (XRP) processes cross-border payments for banks in seconds versus days.

2. Supply Chain Management

Transparency and Traceability: Track products from origin to consumer, verifying:

- Authenticity

- Ethical sourcing

- Quality standards

- Regulatory compliance

Walmart + IBM Food Trust: Traces food products from farm to store, reducing food safety investigation time from days to seconds. During contamination incidents, pinpoint affected products instantly.

De Beers Blockchain: Tracks diamonds from mine to retail, ensuring conflict-free sourcing and preventing counterfeits.

3. Healthcare

Medical Records:

- Patient-controlled health data

- Interoperability between providers

- Secure, immutable health history

- Emergency access protocols

Drug Traceability: Combat counterfeit pharmaceuticals by tracking medications through supply chain. MediLedger network used by major pharmaceutical companies.

Clinical Trials: Ensure data integrity and prevent result manipulation in medical research.

4. Digital Identity

Self-Sovereign Identity: Individuals control their own identity data rather than relying on centralized authorities.

Benefits:

- Reduce identity theft

- Streamline KYC (Know Your Customer) processes

- Enable privacy-preserving verification

- Portable identity across services

Example: Estonia's e-Residency program uses blockchain for digital identity, allowing global entrepreneurs to start EU companies remotely.

5. Real Estate

Property Records:

- Immutable ownership records

- Reduced fraud

- Faster transfers

- Lower transaction costs

Tokenization: Fractional ownership of real estate through blockchain tokens, democratizing property investment.

Smart Contract Escrow: Automatic fund release when contract conditions are met, eliminating traditional escrow services.

6. Voting and Governance

Blockchain Voting:

- Tamper-proof vote recording

- Transparent vote counting

- Increased accessibility (remote voting)

- Reduced costs

Challenges: Voter privacy while maintaining verifiability remains a complex problem being actively researched.

7. Intellectual Property and Royalties

NFTs (Non-Fungible Tokens): Prove ownership and authenticity of digital assets:

- Digital art

- Music

- Virtual real estate

- In-game items

Automated Royalties: Smart contracts automatically distribute royalties to creators when their work is sold or used.

8. Gaming

Play-to-Earn: Players truly own in-game assets and can trade them for real value.

Interoperability: Assets usable across multiple games and platforms.

Example: Axie Infinity players earn cryptocurrency through gameplay, with some in developing countries earning more than local wages.

Multi-Chain Ecosystems: Beyond Single Blockchains

The Multi-Chain Vision

Initially, blockchains operated as isolated networks. The multi-chain paradigm recognizes that different blockchains serve different purposes and must interoperate.

Why Multiple Chains?

1. Specialization:

- Bitcoin: Store of value and payments

- Ethereum: Smart contracts and DeFi

- Solana: High-speed transactions

- Polygon: Ethereum scaling

- Avalanche: Custom blockchain networks

2. Scalability: No single blockchain can handle all global transactions efficiently.

3. Governance Diversity: Different communities prefer different governance models.

4. Technology Evolution: New blockchains experiment with novel consensus mechanisms and features.

Layer 1 vs Layer 2 Solutions

Layer 1 (Base Blockchains):

- Bitcoin, Ethereum, Solana, Cardano

- Independent consensus mechanisms

- Native security guarantees

Layer 2 (Scaling Solutions): Built on top of Layer 1 blockchains:

- Rollups: Arbitrum, Optimism (batch transactions off-chain)

- State Channels: Lightning Network (off-chain transactions)

- Sidechains: Polygon (independent chains with periodic checkpoints)

Benefits:

- Higher transaction throughput

- Lower fees

- Inherits Layer 1 security

Interoperability: Connecting Blockchains

Cross-Chain Bridges: Transfer assets between different blockchains.

Example: Move ETH from Ethereum to Polygon, use it in Polygon DeFi apps, then bridge back to Ethereum.

Bridge Types:

- Trusted Bridges: Rely on centralized operators

- Trustless Bridges: Use smart contracts and cryptographic proofs

Challenges: Bridges have become major targets for hackers, with billions stolen. Securing cross-chain communication remains a critical challenge.

Interoperability Protocols:

- Polkadot: Parachain architecture connecting specialized blockchains

- Cosmos: Inter-Blockchain Communication (IBC) protocol

- Chainlink CCIP: Cross-Chain Interoperability Protocol

The Oracle Problem: Connecting Blockchain to Reality

Understanding the Oracle Problem

Blockchains are deterministic systems—they can only process information that exists on the blockchain. However, many useful applications require external data:

- Current weather conditions

- Stock prices

- Sports game outcomes

- IoT sensor data

- Random numbers

The Problem: Blockchains cannot directly access external data sources. They need "oracles"—services that fetch and deliver external data to smart contracts.

The Dilemma: Using centralized oracles reintroduces the single point of failure that blockchain was designed to eliminate.

Why Oracles Are Critical

Example: Insurance Smart Contract

// Crop insurance that pays out if drought occurs

if (rainfall < threshold) {

payInsurance();

}

The smart contract needs rainfall data from the real world. Without reliable oracles, this contract cannot function.

Real-World Oracle Use Cases:

- DeFi: Asset price feeds for lending protocols

- Insurance: Weather data, flight delays

- Gaming: Random number generation

- Supply Chain: IoT sensor data

- Prediction Markets: Real-world event outcomes

The Security Challenge

Centralized Oracle Risks:

- Single point of failure: Oracle goes down → smart contracts fail

- Data manipulation: Malicious oracle can feed false data

- Trust requirement: Defeats blockchain's trustless nature

Example Attack: A DeFi lending protocol relies on a price oracle. If an attacker manipulates the oracle to report ETH price as $1 instead of $3,000, they could:

- Deposit $1 worth of collateral

- Borrow $3,000 worth of assets

- Walk away with stolen funds

Historical Incident: In 2020, Harvest Finance lost $34 million when attackers exploited price oracle manipulation.

Chainlink: Solving the Oracle Problem

What Is Chainlink?

Chainlink is a decentralized oracle network that provides reliable, tamper-proof data to smart contracts while maintaining blockchain's security guarantees.

Core Innovation: Instead of relying on a single oracle, Chainlink aggregates data from multiple independent node operators, making manipulation nearly impossible.

How Chainlink Works

1. Data Request: Smart contract requests external data (e.g., ETH price)

2. Oracle Selection: Chainlink selects multiple independent oracle nodes to fulfill the request

3. Data Retrieval: Each node independently fetches data from multiple sources

4. Aggregation: Responses are aggregated (median, average, etc.) to remove outliers

5. On-Chain Delivery: The aggregated result is delivered to the requesting smart contract

6. Verification: The data comes with cryptographic proof of its source and integrity

Chainlink's Decentralization Layers

1. Data Source Decentralization: Fetch data from multiple APIs (CoinGecko, CoinMarketCap, Binance, etc.)

2. Oracle Node Decentralization: Multiple independent node operators retrieve and report data

3. Aggregation: Consensus algorithm combines reports, removing outliers and malicious data

Chainlink Services

Price Feeds: Provide accurate, up-to-date cryptocurrency and asset prices for DeFi protocols.

Verifiable Random Function (VRF): Generate provably fair random numbers for gaming and NFTs.

Proof of Reserve: Verify that wrapped tokens are backed by real assets.

Cross-Chain Interoperability Protocol (CCIP): Enable secure communication between different blockchains.

Any API: Connect smart contracts to any web API for custom data needs.

Real-World Chainlink Usage

Aave: Leading DeFi lending protocol uses Chainlink price feeds to determine collateral values and liquidation thresholds. Secures over $10 billion in assets.

Synthetix: Decentralized derivatives platform relies on Chainlink for accurate asset prices.

Insurance: Parametric insurance products (crop insurance, flight delay insurance) use Chainlink to verify trigger conditions.

Smart Contracts: Programmable Agreements

What Are Smart Contracts?

A smart contract is self-executing code stored on a blockchain that automatically enforces the terms of an agreement when predefined conditions are met.

Traditional Contract:

If Alice pays $1000, then Bob transfers house ownership to Alice.

(Requires lawyers, escrow, manual verification)

Smart Contract:

function purchaseHouse() payable {

require(msg.value == 1000 ether);

houseOwner = msg.sender;

}

(Executes automatically, trustlessly, transparently)

The Purpose of Smart Contracts

1. Trustless Execution No need to trust counterparties—code enforces agreements automatically.

2. Elimination of Intermediaries Remove lawyers, notaries, escrow services, reducing costs and delays.

3. Transparency Contract terms are publicly visible and verifiable.

4. Immutability Once deployed, contracts cannot be altered (by design).

5. Composability Smart contracts can interact with other smart contracts, creating complex financial instruments.

Smart Contract Anatomy

Basic Structure (Solidity):

// SPDX-License-Identifier: MIT

pragma solidity ^0.8.0;

contract SimpleContract {

// State variables (stored on blockchain)

address public owner;

uint256 public balance;

// Constructor (runs once at deployment)

constructor() {

owner = msg.sender;

}

// Function (can be called by users)

function deposit() public payable {

balance += msg.value;

}

// Function with access control

function withdraw(uint256 amount) public {

require(msg.sender == owner, "Only owner can withdraw");

require(balance >= amount, "Insufficient balance");

balance -= amount;

payable(owner).transfer(amount);

}

}

Key Components:

- State Variables: Data stored permanently on blockchain

- Functions: Operations that can be executed

- Modifiers: Access control and validation

- Events: Notifications emitted when things happen

Smart Contract Platforms

Ethereum:

- First and most popular smart contract platform

- Solidity programming language

- Largest developer community

- Most established DeFi ecosystem

Alternatives:

- Solana: High-speed, low-cost (Rust/C)

- Cardano: Research-driven approach (Plutus/Haskell)

- Polkadot: Multi-chain smart contracts (Ink!)

- Avalanche: High throughput (Solidity compatible)

The Ethereum Virtual Machine (EVM)

What Is the EVM?

The Ethereum Virtual Machine is a decentralized computer that runs on thousands of nodes simultaneously, executing smart contracts in a secure, isolated environment.

Think of it as: A world computer where anyone can deploy code that runs exactly as programmed without possibility of downtime, censorship, fraud, or third-party interference.

How the EVM Works

1. Code Compilation:

Solidity Code → Compiler → Bytecode

2. Deployment: Bytecode is deployed to the blockchain as a transaction.

3. Execution: When someone interacts with the contract, the EVM:

- Loads the bytecode

- Executes it in a sandboxed environment

- Updates blockchain state

- Returns results

4. Gas System: Every computational operation costs "gas" (paid in ETH), preventing infinite loops and spam.

EVM Architecture

Stack-Based Virtual Machine:

- 256-bit word size (optimized for cryptography)

- 1024 stack depth maximum

- Deterministic execution (same input always produces same output)

Memory:

- Storage: Persistent data on blockchain (expensive)

- Memory: Temporary data during execution (cheaper)

- Stack: Execution workspace (cheapest)

Gas Mechanism:

Simple operation (addition): 3 gas

Storage write: 20,000 gas

Contract deployment: ~50,000+ gas

Gas price fluctuates based on network demand, creating a market for blockchain computation.

EVM Compatibility

Why It Matters: Many blockchains are "EVM-compatible," meaning they can run Ethereum smart contracts without modification:

- Polygon

- Binance Smart Chain

- Avalanche C-Chain

- Fantom

- Arbitrum, Optimism (Layer 2s)

Benefits:

- Developers write code once, deploy everywhere

- Tools and infrastructure work across chains

- Applications can be multi-chain by default

EVM Limitations and Innovations

Limitations:

- Sequential execution (no parallelism)

- Relatively slow (15-30 transactions per second on Ethereum)

- Expensive during high network usage

Solutions:

- Layer 2 scaling (Rollups)

- Alternative VMs (Solana's Sealevel, Aptos' Move VM)

- EVM improvements (EIP-4844, upcoming upgrades)

Benefits of Smart Contracts

1. Automation and Efficiency

Before Smart Contracts:

- Manual contract execution

- Lawyers verify conditions

- Escrow services hold funds

- Days or weeks to complete

With Smart Contracts:

- Automatic execution when conditions met

- No human intervention required

- Instant settlement

- Minutes to complete

Example: Insurance claim for flight delay:

- Traditional: Submit claim, wait for review, receive payment (days/weeks)

- Smart Contract: Flight delay verified by oracle → payment automatic (minutes)

2. Cost Reduction

Eliminated Expenses:

- Legal fees

- Intermediary commissions

- Processing fees

- Administrative overhead

Real Numbers: Traditional escrow: 1-2% of transaction value Smart contract: <$50 regardless of transaction size

3. Trust Minimization

Traditional System: Trust required in:

- Counterparty

- Lawyers

- Escrow services

- Legal system

Smart Contracts: Trust only in:

- Code (which is publicly verifiable)

- Blockchain network (secured by thousands of nodes)

4. Transparency and Auditability

Public Verification: Anyone can verify:

- Contract code

- Transaction history

- Current state

Regulatory Compliance: Automatic compliance checking and reporting.

5. Accuracy and Error Reduction

Human Contracts:

- Ambiguous language

- Misinterpretation

- Manual errors

Smart Contracts:

- Precise logic

- Unambiguous execution

- Deterministic results

6. Security (When Done Right)

Cryptographic Security:

- Private key control

- Immutable code

- Transparent operations

Caveat: Bugs in smart contract code can be exploited. Professional audits are essential.

7. Composability: Money Legos

Smart contracts can interact with other smart contracts, creating complex financial instruments:

DeFi Strategy:

1. Borrow DAI from Compound

2. Trade DAI for USDC on Uniswap

3. Deposit USDC into Aave

4. Use aUSDC as collateral to borrow more

5. Repeat (leverage)

All executable in a single transaction through smart contract composition.

The Future of Blockchain Technology

Emerging Trends

1. Central Bank Digital Currencies (CBDCs) Governments exploring blockchain-based national currencies.

2. Enterprise Blockchain Adoption IBM, Microsoft, Amazon offering blockchain services.

3. Web3 and Decentralized Internet Blockchain-based internet infrastructure owned by users, not corporations.

4. AI + Blockchain AI models trained on blockchain data, smart contracts powered by AI.

5. Quantum-Resistant Cryptography Preparing for quantum computing threats.

Challenges Ahead

Scalability: Current blockchains handle 15-4,000 TPS vs Visa's 65,000 TPS.

Energy Consumption: Proof of Work chains consume significant energy (though PoS reduces this by 99%+).

Regulatory Uncertainty: Governments still determining how to regulate blockchain and cryptocurrencies.

User Experience: Complex interfaces and concepts create adoption barriers.

Interoperability: True seamless multi-chain operation remains challenging.

Conclusion: The Blockchain Revolution

Blockchain technology represents a fundamental shift in how we think about trust, ownership, and digital infrastructure. From Bitcoin's revolutionary peer-to-peer payment system to Ethereum's programmable smart contracts, blockchain has evolved from a niche technology into a foundation for the next generation of digital systems.

Key Takeaways:

✅ Decentralization eliminates single points of failure and control

✅ Smart contracts enable trustless, automated agreements

✅ Multi-chain ecosystems provide specialized solutions for different needs

✅ Oracles like Chainlink connect blockchains to real-world data

✅ The EVM provides a decentralized computing platform

✅ Real-world adoption is accelerating across industries