Web3 Smart Contract Auditing: The Complete Beginner's Guide to Securing Your Code

Master smart contract auditing from fundamentals to advanced techniques. Learn from historical hacks, understand OWASP Top 10 vulnerabilities, and discover how professional auditing protects billions in blockchain assets.

In 2024, smart contract vulnerabilities led to over 1.42 billion dollars in losses across 149 documented incidents. That's not a theoretical problem. Those are real projects, real users, and real money that disappeared forever due to code flaws that could have been caught with proper auditing.

The brutal truth is this: blockchain is unforgiving. When your code has a bug in traditional software, you push a patch. When your smart contract has a vulnerability, hackers drain your contract before you can blink, and the transactions are permanent. There's no rollback button, no customer service to call, no insurance claim. The money is gone.

This is why smart contract auditing has become non-negotiable for any serious Web3 project. It's not bureaucracy or red tape. It's the difference between building trust and watching your project collapse.

What Exactly Is Smart Contract Auditing?

Smart contract auditing is a comprehensive security analysis of blockchain code before deployment. Think of it as a combination of code review, penetration testing, and financial analysis rolled into one. An auditor examines your smart contracts line by line, testing assumptions, probing edge cases, and hunting for vulnerabilities that could compromise user funds or break core functionality.

The audit process isn't just about finding bugs. It's about understanding intent. What was the developer trying to do? Are there ways that intent could be subverted? Are there edge cases where the logic fails? What happens under extreme market conditions or when facing adversarial input?

Unlike traditional security audits that might evaluate a finished product, smart contract audits often happen multiple times throughout development. Pre-audit testing, post-deployment monitoring, and re-audits after significant changes are all standard practice in professional Web3 development.

The Historical Context: Learning from Catastrophic Failures

Understanding why auditing matters requires looking at what happens when it doesn't happen. The Web3 industry has learned hard lessons from spectacular failures.

The DAO Hack: The Attack That Split Ethereum

In 2016, the Ethereum ecosystem was only one year old. A groundbreaking project called "The DAO" launched as a decentralized venture capital fund. It was incredibly ambitious, raising over 150 million dollars from more than 11,000 investors. At its peak, The DAO held approximately 14 percent of all Ether in circulation.

On June 17, 2016, a hacker discovered a critical flaw in The DAO's smart contract code. The vulnerability wasn't in Ethereum itself, but in The DAO's specific implementation. The hacker exploited what we now call a "reentrancy attack" to drain funds.

Here's what happened: The DAO's withdraw function sent Ether to the attacker before updating the internal balance record. The attacker's malicious contract had a fallback function that would immediately call withdraw again. This created a recursive loop where the attacker could drain the same funds multiple times before The DAO's balance updated. In the first few hours, the hacker stole 3.6 million ETH, worth about 70 million dollars at the time.

The response to this hack was unprecedented and deeply controversial. The Ethereum community hard forked the blockchain to restore stolen funds, which violated the principle of immutability that underpins blockchain technology. This decision split the Ethereum community. The majority moved forward with the new version, but a minority rejected the fork and continued with the original blockchain, which became Ethereum Classic.

The DAO hack taught the Web3 industry a harsh lesson: code audits aren't optional extras. They're foundational to security.

The Poly Network Hack: 611 Million Dollars in One Transaction

Fast forward to August 2021. Poly Network, a cross-chain bridge protocol, was hacked in what became the largest cryptocurrency theft in DeFi history. Over 611 million dollars were stolen across multiple blockchains in a single coordinated attack.

The vulnerability? Missing input validation in cross-chain operations. The attacker exploited insufficient checks on external data to manipulate contract interactions across different blockchains. They essentially tricked the protocol into giving them control over funds they shouldn't have access to.

What made this hack particularly instructive was that the Poly Network had claimed to be audited. The attack succeeded not because the team was incompetent, but because auditing is complex. A single oversight in cross-chain validation logic propagated across multiple blockchains, creating a catastrophic failure.

Interestingly, the attacker eventually returned all 611 million dollars. But that doesn't change the core lesson: lack of rigorous auditing nearly caused a protocol collapse.

Other Notable Exploits

The Bancor Network hack in 2018 stole 13.5 million dollars by exploiting weak access controls. Attackers gained control of a wallet with elevated permissions and executed unauthorized token transfers. The attack was possible because access control wasn't properly audited.

The Wormhole bridge was hacked in 2022 for 326 million dollars due to missing signature verification in cross-chain operations. In 2024, Euler Finance lost 197 million dollars to a donation attack despite having multiple audits, and Platypus Finance fell victim to a flash loan attack that cost 9 million dollars.

These aren't isolated incidents or freak accidents. They're patterns. Access control flaws, reentrancy vulnerabilities, missing validation, and improper external call handling appear repeatedly across different projects. Professional auditing catches these issues before deployment.

The OWASP Smart Contract Top 10: Understanding the Critical Vulnerabilities

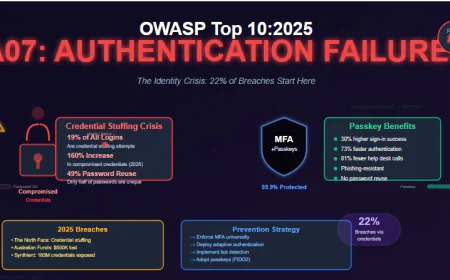

The Open Web Application Security Project (OWASP) released its Smart Contract Top 10 for 2025 based on analysis of 149 documented security incidents and 1.42 billion dollars in losses. These ten vulnerability categories represent the real-world threats that auditors focus on.

1. Access Control Vulnerabilities (953.2 Million in Losses)

Improper permission checks are the leading cause of smart contract hacks. These vulnerabilities allow unauthorized users to access or modify critical functions and data.

The 88mph Function Initialization Bug exemplifies this category. Developers created a contract but forgot to update the constructor name when making code changes. This left a function that should have been private accessible to anyone. An attacker could reinitialize the contract and gain administrative privileges, leading to unauthorized fund withdrawals.

Access control vulnerabilities arise when developers fail to implement proper role-based access control (RBAC), overlook function visibility settings, or don't restrict sensitive functions appropriately. A missing "onlyOwner" modifier might seem like a small oversight, but it can hand complete control to attackers.

Prevention Techniques: Use role-based access control frameworks, implement principle of least privilege, restrict function visibility explicitly, and audit all permission logic regularly.

2. Price Oracle Manipulation (Continuing Threat)

DeFi protocols depend on price feeds to determine asset values, collateral ratios, and liquidation triggers. Attackers exploit weak oracle mechanisms to manipulate these prices temporarily, enabling unfair liquidations and arbitrage opportunities.

In 2024, BonqDAO suffered 120 million dollars in losses when attackers manipulated oracle data. They exploited the lending platform's reliance on weak price feeds to trigger unfair liquidations. The protocol had been audited, but the oracle integration wasn't sufficiently scrutinized.

Prevention Techniques: Use decentralized oracle networks like Chainlink, implement price feed redundancy, calculate prices using average values over time, and add circuit breakers that pause operations during suspicious price movements.

3. Logic Errors (63.8 Million in Losses)

Business logic flaws occur when smart contracts fail to execute their intended functions correctly. These errors don't always look like security bugs in traditional terms, but they can be exploited for financial gain.

Incorrect token minting, flawed lending protocols that calculate interest wrong, and reward distributions that don't match specifications all fall into this category. These vulnerabilities are often discovered not through automated tools but through understanding protocol intent and finding ways that intent can be subverted.

Prevention Techniques: Perform thorough unit and integration testing, conduct regular peer code reviews, test edge cases systematically, and verify calculations against mathematical specifications.

4. Reentrancy Attacks (35.7 Million in Losses)

Reentrancy vulnerabilities allow attackers to recursively call functions before state updates complete. The DAO hack made this vulnerability famous, but it remains relevant in modern contracts, especially in complex interactions.

The classic reentrancy pattern: contract A calls contract B, contract B's fallback function calls back into contract A before contract A finished its state update. This allows B to operate on stale state and extract more value than it should.

Prevention Techniques: Follow the "Checks-Effects-Interactions" pattern: validate inputs first, update state second, and only then interact with external contracts. Use reentrancy guards that prevent recursive calls.

5. Unchecked External Calls (550.7 Thousand in Losses)

When smart contracts fail to verify the success of external function calls, they risk proceeding with incorrect assumptions. A called contract might fail, but the calling contract doesn't check for this and proceeds as if success occurred.

In Solidity, a failed external call returns false but doesn't automatically revert the transaction. If developers don't explicitly check the return value, they might build logic on false assumptions.

Prevention Techniques: Always check return values from external calls, use call wrappers that revert on failure, and implement proper error handling for all external interactions.

6. Flash Loan Attacks (33.8 Million in Losses)

Flash loans allow users to borrow massive amounts of capital without collateral as long as they repay within the same transaction. While useful for arbitrage and liquidations, they can be weaponized to manipulate protocols.

An attacker might borrow a large amount, use it to manipulate a price oracle or drain a liquidity pool, and repay the loan in the same transaction with profits extracted from the manipulation. The protocol never realizes the attack happened.

Prevention Techniques: Implement time-weighted price averages rather than spot prices, use oracle redundancy, and add safeguards against large single-transaction manipulation.

7. Arithmetic Errors and Underflow/Overflow (Variable Losses)

Solidity uses fixed-size data types for integers. If calculations exceed these limits, unexpected behavior occurs. Unsigned integers wrap around on underflow, potentially causing incorrect balance calculations that allow token theft.

Modern Solidity (0.8+) includes overflow/underflow protection by default, but older contracts and custom arithmetic operations can still be vulnerable.

Prevention Techniques: Use SafeMath libraries for older Solidity versions, enable compiler overflow/underflow checks, validate calculation bounds before operations, and test for extreme values.

8. Improper Randomness (Critical for Games and Lotteries)

Blockchains are deterministic, making generating truly random numbers challenging. If contracts rely on block.timestamp or block.number for randomness, attackers can predict outcomes.

A lottery contract that uses block.timestamp to generate random winners is broken because miners can adjust timestamps. Attackers can predict what the "random" outcome will be.

Prevention Techniques: Use Chainlink VRF or similar cryptographic randomness services, never rely on block.timestamp or block.number for randomness, and implement commit-reveal schemes for on-chain randomness.

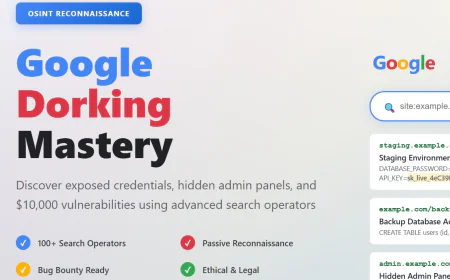

9. Input Validation Flaws (Continuing Threat)

Failing to validate or properly sanitize inputs allows malicious data to disrupt contract functionality. This is a Web2 security principle that applies equally to smart contracts.

Without proper input validation, attackers can pass unexpected data types, extreme values, or malformed data that breaks contract logic.

Prevention Techniques: Validate every input parameter, check data type constraints, verify value ranges, implement whitelist-based validation where possible, and use static analysis tools to catch validation issues.

10. Denial of Service (DoS) Through Resource Exhaustion

Gas limits on blockchains constrain computation. Functions that iterate over unbounded arrays risk exceeding block gas limits, causing legitimate transactions to fail.

An attacker might manipulate contract state to create arrays of millions of elements, making critical functions unusable. This effectively disables the contract without "hacking" it in traditional terms.

Prevention Techniques: Implement bounded loops with explicit length limits, avoid iterating over unbounded arrays, batch operations across transactions, and optimize gas usage extensively.

How Professional Smart Contract Auditing Works

Now that you understand the vulnerabilities, how do professional auditors actually find and assess them?

Phase 1: Preparation and Scoping

Before the audit begins, clear goals matter more than you might think. Rather than vague objectives like "find every bug," successful audits specify concrete goals: "Protect user funds in our L2 bridge," "Validate key rotation design," or "Ensure reentrancy resistance."

The development team should freeze a tagged release, document all assumptions, provide architecture diagrams, share tokenomics models, and prepare comprehensive unit tests. High test coverage helps auditors understand intended behavior and focus on subtle logic flaws rather than obvious defects.

Phase 2: Automated Analysis

Auditors first run smart contracts through static analysis tools like Slither, Mythril, and Semgrep. These tools scan for known vulnerability patterns at machine speed: deprecated functions, missing access checks, unchecked external calls, and common reentrancy patterns.

Automated tools catch low-hanging fruit quickly, allowing human auditors to focus on sophisticated vulnerabilities that require understanding protocol economics and edge cases.

Phase 3: Manual Code Review

The core of any serious audit is human expertise. Auditors read code line by line, understanding intent and probing for flaws. They trace execution paths, model state changes, and ask: "What could go wrong here?"

Manual review identifies logic errors, economic vulnerabilities, and subtle interactions between contracts that automated tools miss.

Phase 4: Testing and Exploitation

Top-tier auditors don't just identify vulnerabilities; they build proofs of concept that demonstrate impact. Can they actually exploit the vulnerability? What would an attack look like? How much damage could it cause?

This transforms abstract findings into concrete evidence of real risk.

Phase 5: Reporting and Remediation

The audit culminates in a detailed report categorizing findings by severity: P0 (funds at risk), P1 (core functionality broken), P2 (efficiency issues), and P3 (nice-to-haves).

The development team triages findings, fixes high-priority issues, writes tests that fail before the fix and pass after, and submits diffs for re-testing. Good auditors provide this remediation review to ensure fixes are actually effective.

The Tools Professional Auditors Use

Modern auditing combines human expertise with specialized tools:

Slither provides static analysis identifying common vulnerabilities in Solidity code quickly.

Mythril uses symbolic execution to explore multiple code paths and detect vulnerabilities like reentrancy and integer overflow.

Foundry enables fuzz testing where random inputs are fed to contracts to find edge cases and breaking points.

Echidna from Trail of Bits runs property-based fuzzing to validate that contracts maintain desired invariants under random input.

SolidityScan and QuillShield provide AI-powered vulnerability detection learning from past exploits to identify new attack patterns.

Solodit aggregates smart contract vulnerabilities and bug bounties, serving as a research database for auditors.

Professional auditors typically combine multiple tools, understanding that no single tool catches all issues.

Smart Contract Audit Costs and Timeline

Audit pricing varies significantly based on complexity. A simple ERC-20 token might cost 8,000 to 15,000 dollars. A complex DeFi protocol with multiple interacting contracts might run 50,000 to 150,000 dollars or more for cross-chain systems.

Timelines also vary dramatically. A straightforward Solidity contract on Ethereum might take 2-4 weeks. Complex cryptography-focused work (multi-signature systems, zero-knowledge proofs) requires 2-3 months advance booking.

Rather than viewing audit costs as expenses, savvy teams treat them as risk-adjusted investments. The cost of a 100,000 dollar audit is trivial compared to the risk of a 10 million dollar hack.

Beyond Auditing: Building an Auditing Career

If this deep dive into vulnerabilities interests you, consider that smart contract auditing is becoming a high-demand career. The industry is starving for talented security professionals.

Start by learning Solidity thoroughly. Build projects. Participate in bug bounty programs like Immunefi. Compete in capture-the-flag (CTF) competitions designed for smart contract security. Read audit reports from reputable firms to understand what professionals focus on.

As you progress, the progression goes: bug bounties → competitive audits → part-time auditing → professional auditing roles. Top auditors combine deep programming knowledge, security instincts, and economic understanding of DeFi. It's challenging work, but the field desperately needs more talented people.

Conclusion

✅ Smart contract auditing stands between Web3 projects and catastrophic failure. The DAO hack, Poly Network breach, and countless smaller exploits all trace back to the same root cause: insufficient security scrutiny before deployment.

✅ The OWASP Smart Contract Top 10 provides a roadmap for understanding the most critical vulnerabilities. Professional auditing combines automated tools with human expertise to catch both obvious and subtle flaws. Historical hacks teach hard lessons about what happens when auditing is skipped or inadequate.

✅ For anyone building in Web3, auditing isn't optional. It's the foundation of trustworthy applications. The projects that win long-term are those that treat security not as a final checkbox, but as a core development principle.