The Hidden Digital Risks in New Business Acquisitions

Discover critical cybersecurity risks in mergers and acquisitions. Learn from the 2024 Coinbase data breach and protect your M&A deals from hidden digital threats and vulnerabilities.

When companies participate in mergers and acquisitions (M&A), they seldom consider the unanticipated cybersecurity challenges hidden under the iceberg. However, the situation is very clear; 70% of the mergers do not get the intended financial results, and poor cybersecurity and data leak occurrences are among the main reasons for this high rate.

The cybersecurity threats have changed drastically, especially after incidents that caught the attention of the whole industry, one of them being the Coinbase data breach incident of 2024, which had a significant impact on the financial technology market. This thorough investigation discusses the lessons that the Coinbase data breach teaches to the companies involved in mergers and acquisitions, the characteristics of the data breach 2024 incidents and to what extent the strong cybersecurity frameworks can help the organizations that are merged to survive the catastrophic failure of their security.

Theory of the interrelationship among cybersecurity, data breach 2024 vulnerabilities, and lessons from the Coinbase data breach is a must for any organization that is weighing acquisition strategies as its core business.

Understanding Digital Risk in M&A

The Cybersecurity Paradox in Acquisitions

Mergers between companies come with the whole range of operational assets and also the complete cybersecurity setup of the target company including all its weaknesses, The difficulty of unifying security infrastructures of two companies is mostly underestimated when planning acquisitions.

A strong cybersecurity posture demands:

- An all-encompassing implementation of security measures common to all systems

- A common ground for threat detection and response

- Aligned access control and authentication systems

Joint cybersecurity incident response plans

The security situation during integration gets divided. A divided situation provides a chance for hackers to take advantage of the weaknesses. The risk of a security breach grows a lot during the post-acquisition period, especially around the time when the cybersecurity teams are not monitoring for threats actively, as they are busy with integration.

Why Cybersecurity Due Diligence Fails

A number of acquiring companies carry out financial and legal due diligence but do not assign adequate resources for the assessment of cybersecurity, which is a major mistake for the following reasons:

- Financial performance can be directly affected by cybersecurity vulnerabilities

- Massive fines and loss of reputation are among the consequences of data breach incidents

Coinbase data breach is an example of a very well-capitalized tech company suffering a great deal of security failure. Not complying with cybersecurity regulations can lead to the cancellation of an acquisition agreement even after it has been finalized.

2024-The Growing Issue of Data Breach

Rapidly Growing Data Breach Trends in 2024

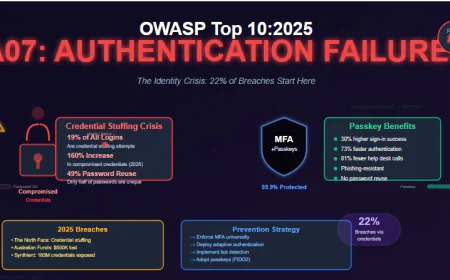

The year 2024 has seen the data breach landscape dominated by very sophisticated attacks targeting unprotected companies at risky times, like mergers. The data breach incidents 2024 were:

- A volume growth: The volume of data breach incidents in 2024 rose 40% when compared to 2023.

- A sophistication rise: Cyber flaw exploitation by attackers has already begun in the M&A integration phase.

- A focus on targets has increased: The data breach events in 2024 have mainly affected the financial and technological sectors.

- The recovery costs: Responding to a data breach was more than $4.5 million on average in the year 2024.

The Post-Acquisition Data Breach Window

Organizations face a major vulnerability window during the post-acquisition period. This is the time when:

- Cybersecurity teams are divided and unfocused

- Security policies are not the same for both companies

- Control of system access is being altered

- Cybersecurity surveillance tools could be switched off for a short time during the integration

The vulnerability window has attracted the attention of the most advanced threat actors who are looking to take advantage of the cybersecurity disorder caused by acquisition periods. Data breach incidents 2024 that specifically target M&A scenarios have gone up by 65%.

Regulatory Response to Data Breach 2024

The regulatory authorities have taken the following measures as a result of the increasing incidence of data breaches in 2024:

1. Improved cybersecurity standards for acquisition disclosures

2. More severe penalties for data breach incidents occurring after acquisitions

3. Complete cybersecurity insurance coverage with higher limits required

4. Comprehensive cybersecurity risk evaluations before acquisitions necessary

Firms that do not fix their cybersecurity issues before being acquired now not only have to pay for their mistakes but also have to deal with regulatory oversight in the area of data breach prevention and detection.

The Coinbase Data Breach: A Wake-Up Call

Getting to Know the Context of Coinbase Data Breach

The Coinbase data breach case that came to light in 2024 became a turning point for the technology mergers and acquisitions world to be more conscious of the cybersecurity risks. The breach showed important flaws in the integration of the cybersecurity frameworks of the subsidiaries that were bought.

How the Coinbase Data Breach Was Able to Point out the Unsafeguarded Areas

The blockchain platform showed one of the biggest online crypto exchanges that:

- The integration of cybersecurity is more difficult than anticipated

- The very sophisticated cybersecurity infrastructure may also break down during the transition period

- Data leak prevention will, thus, need constant attention even post-acquisition

- The acquired company’s old cybersecurity systems will always be a source of risk

The Coinbase Thereby Breach, in particular, brought to light:

- Lack of cybersecurity communication between the involved companies

- Problems with user access control across the different cybersecurity systems

- Inadequate employee training on the new cybersecurity measures

- Insufficient procedures for incident response across unified cybersecurity systems

Direct Lessons from the Coinbase Data Breach

The Coinbase data breach proved to be a significant learning experience for the whole industry:

- Lesson 1: There should be no less rigor in cyber security due diligence than in financial audits. Although Coinbase had great resources for cyber security, still the data breach occurred.

- Lesson 2: If there is misalignment in the cybersecurity frameworks, the risk of data breaches increases by a lot. The Coinbase incident showed that when two companies have different cybersecurity protocols, it gives a chance to the hacker to penetrate.

- Lesson 3: Cybersecurity Integration after acquisition calls for a lot of resources. The Coinbase case exposed that there was not enough investment in the merging of cybersecurity systems.

- Lesson 4: Cybersecurity must be always transparent. The Coinbase incident emphasized the necessity of the prompt notification of security breaches and other incidents.

The Coinbase Data Breach Impact on Cybersecurity Standards

After the Coinbase cyber incident, the market standards for cybersecurity progressed:

- More rigorous cybersecurity evaluation protocols for merger and acquisition transactions

- Setting up a mandatory cybersecurity merger planning requirement

- Increasing capital allocation for cybersecurity equipment and workforce

- More stringent requirements for cybersecurity insurance after the takeover

Cybersecurity Vulnerabilities in Acquired Companies

Legacy System Cybersecurity Challenges

Previously acquired companies often have outdated cybersecurity systems, and the cybersecurity problems include:

- Vulnerable unpatched systems that can be exploited

- Old cybersecurity tools that cannot work with modern frameworks

- Ineffective cybersecurity monitoring capabilities

Cybersecurity measures that are too old for today's threats

The Coinbase data breach is a perfect case showing that old cybersecurity systems can be a burden. It is necessary to make a security plan that takes into account the integration of the systems to avoid creating new ways for data breaches.

Cybersecurity Staffing Gaps

The organizations that have been acquired might possess:

- Cybersecurity team members not enough to cover the whole area

- Security workers not having the latest skills

- Poverty of security knowledge in the company

- High quitting rates of the security department staff

Indeed, these points regarding the lack of cybersecurity may not be recognized until the acquisition process is completed and integration shows clearly the limitation in the number of cybersecurity forces.

Cybersecurity Culture Misalignment

Organizations differ in their cybersecurity cultures:

- Discrepant cybersecurity awareness training

- Diversity in cybersecurity policy enforcement

- Different approaches to response incidents

- Disparate cybersecurity risk tolerances

The Coinbase data breach was an example of how cybersecurity culture misalignment could facilitate attacks during integration.

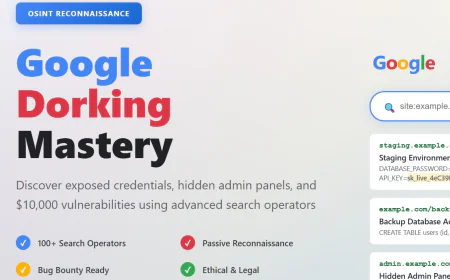

Preventing Data Breach Through Proper Due Diligence

Comprehensive Cybersecurity Assessment Framework

Prior to purchase, organizations will have to finalize their thorough cybersecurity assessment which will include:

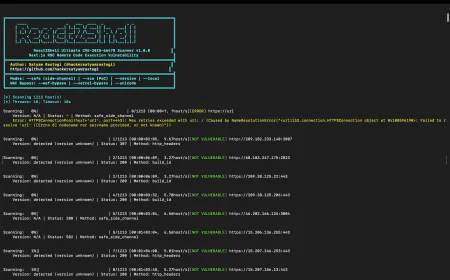

- Technical Cybersecurity Evaluation:

- Audit of cybersecurity infrastructure

- Penetration testing aimed at revealing cybersecurity weaknesses

- Assessment of the inventory of the cybersecurity tools

- Scanning for data breach vulnerabilities

Organizational Cybersecurity Review:

- The organization’s cybersecurity staff and expertise have been evaluated.

- The cybersecurity training program has been assessed.

- The documentation of the Cybersecurity policy has been reviewed.

- The history of Cybersecurity incidents has been analyzed.

Compliance and Cybersecurity Assessment

- The organization's compliance with cybersecurity regulations has been verified.

- The data breach notification protocol has been reviewed.

- The analysis of the cybersecurity insurance policy has been done.

- Data breach liability has been assessed.

Data Breach Risk Quantification

Organizations have to build frameworks that would serve to quantify the data breach risks as determined by the cybersecurity assessments:

- Likelihood of data breach taking place within certain time frames

- Data breach scenario financial impact possibilities

- Regulatory fine exposure as a result of data breach incidents

- Loss of reputation due to possible data breach incidents

The Coinbase incident of data breach pointed out that the lack of proper quantification of data breach risk results in the underestimation of the amount that the companies should invest in the cybersecurity.

Post-Acquisition Cybersecurity Integration

Phased Cybersecurity Integration Approach

The successful integration of cybersecurity measures necessitates a variety of steps taken in different phases:

Phase 1: Instant Cybersecurity Stabilization

Adopt unified cybersecurity surveillance throughout both companies

Put in place emergency cybersecurity measures to avoid data breach events

Create combined cybersecurity incident response teams

Turn on upgraded cybersecurity threat detection

Phase 2: Cybersecurity System Rationalization

Merge the cybersecurity tool stacks

Create unified cybersecurity policies and procedures

Link up the cybersecurity access control systems

Standardize the cybersecurity authentication methods

Phase 3: Long-term Cybersecurity Optimization

Make cybersecurity infrastructure more efficient

Upgrade cybersecurity automation and orchestration

Introduce advanced cybersecurity analytics

Develop predictive cybersecurity capabilities

The Coinbase data breach was partially caused by lack of proper cybersecurity integration planning, hence the critical need of this phased approach was highlighted.

Cybersecurity Personnel Integration

Successful cybersecurity team integration needs to-have:

Unambiguous definitions of cybersecurity roles

Unified frameworks based cybersecurity training

Cybersecurity team building along with trust development

Establishment of cybersecurity knowledge transfer protocols

Constructing Resistance to Future Data Breaches

Continuous Cybersecurity Monitoring

The cybersecurity monitoring in organizations, after acquisition, must be:

- Detection of cybersecurity threats around the clock

- Notification systems for cybersecurity in real-time

- Evaluation of cybersecurity weaknesses all the time

- Monitoring of compliance with cybersecurity rules continually

Data Breach Response Readiness

Firms should get ready for the worst-case scenario in terms of data breaches:

- Detailed plans for responding to cybersecurity incidents

- Practicing cybersecurity incident scenarios regularly

- The channels for notifying about data breaches

- The protocols for communication with cybersecurity stakeholders

The Coinbase data breach highlighted the necessity of having pre-established procedures for the response to cybersecurity incidents that can be activated instantly when a data breach is detected.

Cybersecurity Culture Development

Sustainable cybersecurity is not possible without:

- Training on comprehensive cybersecurity awareness

- Cybersecurity policy measures in place

- Cybersecurity incentives for employees

- Cybersecurity commitment from top management

Industry Implications and Best Practices

Emerging Cybersecurity Standards

Just after the Coinbase data breach, new cybersecurity standards are drawn up:

- Compulsory cybersecurity evaluations before the finalization of the acquisition

- Higher cyber insurance protection requirements

- Clear cybersecurity merger plans that need the board's approval

- Frequent cybersecurity reviews after the acquisition

- Cybersecurity executive supervision made obligatory

Cybersecurity Investment Justification

The Coinbase data breach along with other data breach incidents in 2024 have made it necessary to invest more in cybersecurity:

- Post-incident budgets for cybersecurity going up by 35%

- Hiring more cybersecurity personnel considered as a norm

- Money for cybersecurity tools increasing a lot

- Cybersecurity training being required for everyone

Conclusion

The hidden cybersecurity risks in business acquisitions are one of the most underestimated challenges that modern organizations have to face. The Coinbase data breach of 2024, together with many other data breach 2024 incidents, proves beyond doubt that even the best-equipped organizations can incur heavy losses in terms of cybersecurity if proper acquisition planning is not done.

Before the deal closes, imagine the buyer's IT & Security departments conducting a thorough review of the target's IT & Security departments. The buyer might have to pay a high price if, for example, he or she later discovers that the company's internal cybersecurity practices are outdated and that the whole department is riding on last year's security survey.

Acquisition organizations must think of cybersecurity integration as one with financial or operational. Confessions of the Coinbase data breach indicate that due diligence in relation to cybersecurity calls for a special set of skills and a lot of resources. Preventing data breaches is reliant on the existence of all-encompassing security measures.Cybersecurity integration after buying cannot be put off or done on an low priority.

Being resilient in case of cyber attacks needs continuous support and fundingCorporations can learn from the Coinbase incident and lessen the risk by being proactive, thus, gaining acquisition protection against the escalating data breaches that are similar to the above-mentioned case and furthermore. The winning M&A future is to place cybersecurity on the same level of importance as financial performance metrics.