Safe Online Shopping: How to Protect Your Card Details

Protect your online shopping! Learn essential tips to secure your credit card details from rising cyber threats like phishing & dark web sales. Discover secure websites, payment methods, multi-factor authentication, and how to spot scams to keep your finances safe.

Shopping online has already been tough for a large number of people, however, credit card fraud still keeps on increasing, with e-commerce companies losing a whopping $48 billion each year. The risk has reached the highest point ever since the bad guys are coming up with more and more advanced tactics like AI-driven phishing attacks and using dark web forums for buying and selling. When it comes to learning how to keep your payment information safe, it is not only a matter of preventing the loss of money but also of preventing the theft of your identity and making sure that your online shopping remains safe and secure.

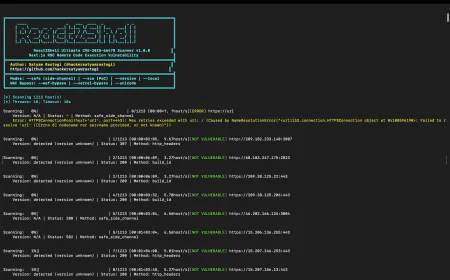

The Growing Threat Landscape

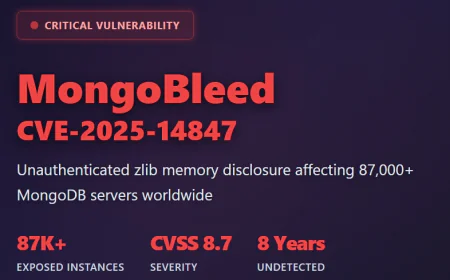

The cybersecurity threats that online shoppers had to face have dramatically changed over time. Information of 119 million stolen payment cards was sold on the dark web in just 2023. Phishing has seized the crown as the number one threat, with online shopping companies being responsible for 41.65% of the financial phishing attempts. Infostealer malware posted approximately 2.3 million bank card leaks on the dark web between the years of 2023 and 2024.

Criminals treat these stolen credentials as commodities and sell them in underground markets or trade them among each other for a higher price. This is a warning of the necessity for both companies and customers to have extremely reliable security measures in place and to be constantly aware of the threats. Intelligence X is one such platform that helps organizations track and find out when their customers' information is on the dark web thus allowing a quick response and handling before the situation gets out of hand and customers become the victims.

Identifying Secure Shopping Websites

Before inputting any payment information, the very first thing you should do is to check the security of the website. The secure sites will have HTTPS encryption, which is shown by the padlock icon on the address bar. This type of encryption makes it impossible for any third party to intercept the credit card numbers because the data being sent and received between the browser and the website is scrambled.

However, the padlock by itself is not completely reliable. The cybercriminals have become so good that they can easily create fake sites that look like the sites of the retailers in question. It is, therefore, advisable to look very closely at the URL for any spelling mistakes or odd domain names especially during the days of big shopping events like Black Friday or Prime Day when scammers are also very active and may easily set up a thousand bogus sites to lure your card information.

Always visit the shopping sites by typing the URL into your browser rather than clicking on links in emails or text messages, which are often phishing vectors. Companies that take security seriously have established comprehensive frameworks for protecting their customers' data. When companies apply risk-first information security programs and through platforms like IntelligenceX handle compliance audits, they not only create safer online transaction ecosystems but also gain customers' trust by being transparent.

Leveraging Secure Payment Methods

The choice of payment option has a considerable effect on your safety. Generally, credit cards give better protection against fraud than debit cards, as they have strong dispute procedures, and also the zero-liability policy for unauthorized charges is applicable only to them.

Of all payment options, virtual credit cards are one of the most secure. Each transaction gets a unique, temporary card number, and thus, the merchant never sees your real card details. Even if the number is compromised, it only works for one transaction and your main account remains secure.

Digital wallets such as Google Pay, Apple Pay and PayPal increase the level of security through both tokenization and end-to-end encryption. During the transaction, tokenization works by replacing your card information with unique codes, ensuring that your actual credit card details do not reach the dealer. These services additionally employ biometric authentication-fingerprint or face recognition-thereby making unauthorized access extremely difficult.

When a payment gateway is PCI DSS certified, it must protect card data through the use of encryption, tokenization, and secure transmission protocols. For companies that have to deal with complicated compliance requirements coming from different standards, providing central compliance management like IntelligenceX can be a great help in showing security controls and being ready for audits all around the infrastructure.

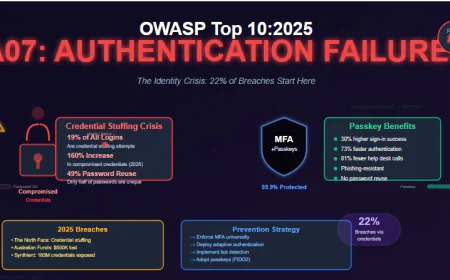

Implementing Multi-Factor Authentication

Two-factor authentication (2FA) is recognized as one of the best security measures available for online accounts. The procedure involves the use of two various forms of verification, which usually are something that you know (password) and something that you have (verification code), or something that you are (biometric data). However, if hackers manage to get your password through phishing, they will still not be able to access your account without the second factor.

The implementation of 2FA is easy: after giving your password, you get a one-time code sent to your phone by text, email, or through an authenticator app, which you then enter to finish logging in. This extra step requires only a few seconds but it considerably minimizes the risk of unauthorized access.

The use of two-factor authentication for online payments within the European Union has been made compulsory as of September 2019 under the Payment Service Directive (PSD2). The approval of 2FA on a large-scale basis demonstrates the ascending acknowledgement that security based solely on passwords is not enough in the current threat environment.

Avoiding Public WiFi for Transactions

Public WiFi networks are insecure, and their risks are sometimes not even noticed by shoppers. One of the problems is that public WiFi networks are usually not encrypted and their data transferred can be easily intercepted by hackers. There's a study showing that 87% of people who use public WiFi are unintentionally exposing their personal information.

Hackers might steal your username, password, and credit card details through man-in-the-middle attacks if you are using the banking app or making purchases via unsecure WiFi. Instead, if you absolutely need to shop online, use a mobile data connection. Compared to public WiFi, mobile networks offer a much higher level of security thanks to the carrier-grade encryption that's used.

On the other hand, you can use a Virtual Private Network (VPN) if you want to encrypt your data while connecting to public networks. VPNs build very strong and secure tunnels that block any kind of interception but still, it's not encouraged to access highly sensitive financial accounts over public WiFi at any time.

Recognizing and Avoiding Phishing Scams

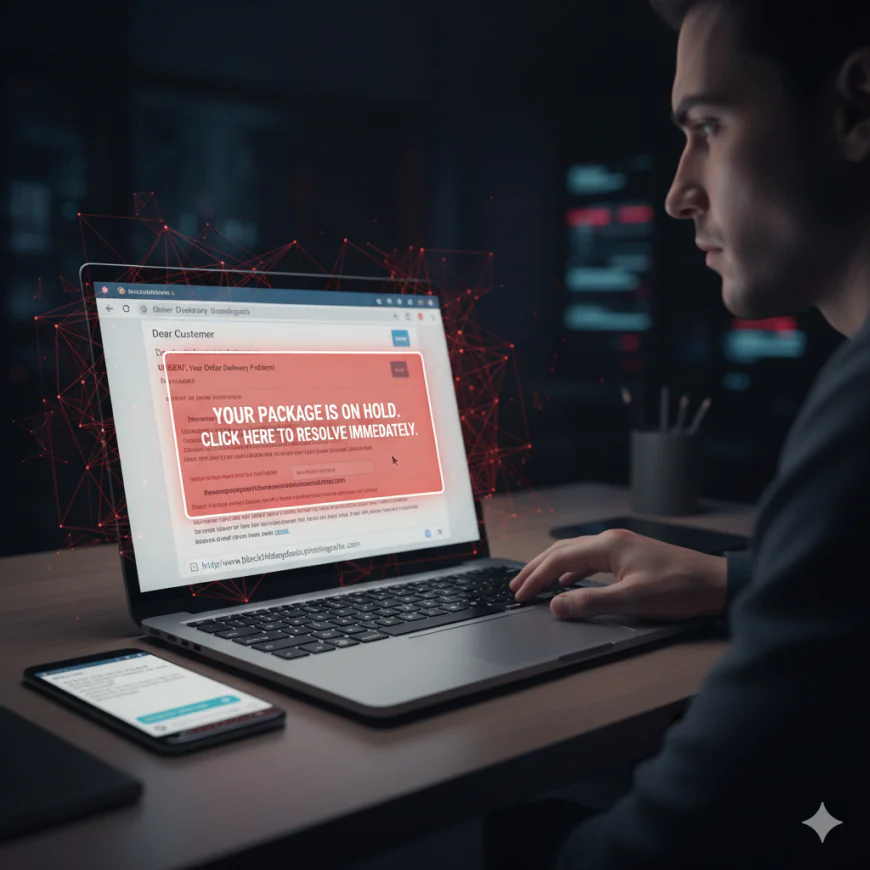

Phishing is still a top the list of cybercrimes, as tech giants combined already filter out close to 100 million phishing emails on a daily basis. In other words, it means that cybercriminals are now using AI among their tools, and with its help, they are sending uncommonly convincing messages that bear your name, mention your recent online purchases, or even refer to your social media activities among others.

The rise in phishing incidents happens at the same time big shopping events are taking place. In the year 2025, 81% of shoppers said they had got at least one message that looked suspicious, and among those were fake limited-time offers and false delivery notifications. The battle against phishing has to be fought with alertness; real companies will kindly use names to call you, while scammers will go for general terms to greet you. Also, be very watchful for typographical errors, strange layout, and very strong language.

Ignoring the links in emails or messages that you did not ask for is the first commandment in the fight against phishing. A better option is to go to marketplaces by writing the URL in your browser straight. You can also see where links will take you by hovering over them before clicking. A good thing to always bear in mind is that no genuine company will ever ask for sensitive information, such as passwords or security codes, via email or text.

Utilizing Password Managers

One of the main difficulties that come along with online security is still the password hygiene issue. The average individual has many accounts, at least one for each service or site, with each one asking for a complex and unique password. Password managers take this problem away by saving all the passwords in a vault that is encrypted and that can be opened only with a single master password.

This kind of tool not only creates long and completely random passwords but also notifies the user if any of the passwords is weak, duplicated, or has been compromised in a data breach. Some of them come with multi-factor authentication integrations, so they further improve security. The best password managers depend on AES-256 encryption and are based on zero-knowledge practices, which means that even the service provider cannot retrieve anyone’s data that has been saved.

In the case of syncing, all the devices-laptops, mobile phones, and tablets-will have access to the same passwords, so wherever your online shopping is going to be in a secure way, your passwords will be available.

Monitoring Your Accounts and Statements

The consistent monitoring of accounts acts as a preliminary alert for detecting any fraudulent activities. Banks or financial institutions suggest that check-up of entire credit card bills should be done every month and that every transaction should be looked at critically. A great number of banks that issue credit cards provide customers with the option of getting alerts regarding their transactions in real-time, which means that you will be notified right away when your card is used.

In case you see fraudulent charges, do not hesitate to take action. Talk to the company that issued your credit card, ask them to block the card that has been compromised, and dispute the charges formally. It is also advisable to report the matter to the police and inform the credit reporting agencies so they can add a fraud alert, which will make it more difficult for the scammers to set up new accounts using your identity.

Conclusion

To ensure the safety of your card details while making purchases over the internet it is a necessity to be always alert and to apply the security measures that have been proven to work. Each of the measures taken, like checking the security of the site, using secured payment methods, activating two-factor authentication, and avoiding public WiFi, adds up to a complete protection against the ever-growing and better organized cyber threats.

The issue of security during online shopping is a shared one. The consumers must act with suspicion all the time and verify the authenticity of the offer. The companies, on the other hand, will have to make more efforts to buy advanced security systems and above all keep PCI DSS certification. The trust that is necessary for the growth of digital trade is established when organizations devise risk-based information security programs that are customized and use platforms such as IntelligenceX to unify compliance management.

It is through the adoption of the tactics in this manual and keeping up with the latest security threats that one can have the peace of mind to shop online knowing that their financial data is still safe from the cybercriminals that are drawing more and more digital transactions to their attention.