Navigating Compliance in 2025: Trends, Challenges & Strategic Shifts

In 2025, the compliance landscape is being reshaped by AI regulation, real-time monitoring mandates, board-level accountability, and regulatory fragmentation. From the EU’s DORA and AI Act to rising False Claims Act enforcement and supplier transparency challenges, compliance is now a strategic differentiator demanding proactive, tech-driven approaches.

Compliance in 2025 has transcended its traditional role as a defensive function. Regulatory mandates like DORA and the AI Act are forcing organizations to elevate compliance into a strategic linchpin—driving operational resilience, governance integrity, and competitive advantage.

Key Trends & Developments

1. Real-Time Compliance & Regulatory Mandates

The EU’s Digital Operational Resilience Act (DORA), enacted in 2025, now compels financial institutions to implement real-time ICT risk monitoring, immutable backups, and rigorous incident response strategies. Noncompliance risks can result in fines up to 2% of global turnover.

Organizations are also demanding integrated dashboards and automation—meeting stakeholder expectations for live visibility and faster response.

2. Heightened Board-Level Accountability

91% of cybersecurity professionals now believe board members should be held responsible for major security lapses, signaling a shift in governance expectations. Senior leadership may now face penalties or prosecution for compliance failures

3. Regulatory Fragmentation & Enforcement Pressure

Compliance professionals grapple with increasing divergence across jurisdictions—particularly around ESG, DEI, and data governance—creating a tug-of-war between risk and agility.

In the U.S., the False Claims Act has become a powerful tool, with over $1.25 billion secured in settlements in 2025, now extending to civil rights and DEI misrepresentations.

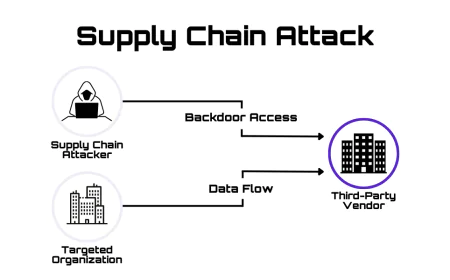

4. Supplier & Supply Chain Transparency

Suppliers face overwhelming demands for regulatory data from multiple brand owners, underscoring the need for interoperable frameworks. The "Compliance Canvas" by TrusTrace offers one such unified structure.

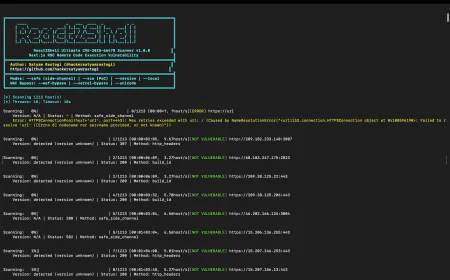

5. AI in Compliance — Dual Use

AI is both a tool and a regulatory focal point. In the EU, the AI Act is pushing compliance into the realm of algorithmic transparency and accountability. Legal teams are evolving into strategic partners—guiding organizations in AI governance.

Additionally, AI is being used to enhance supplier monitoring, predictive risk assessment, and bias mitigation in third-party relationships.

6. Evolving Regulatory Priorities

Gartner reports that over 82% of compliance leaders faced issues due to third-party risks in the past year—making this a top priority area.

Similarly, strategic risk management, ESG compliance, and program performance tracking are at the forefront—and organizations are leaning on metrics and automation to manage complexity.

Why These Trends Matter

-

Operational Resilience: Real-time oversight and compliance capabilities are becoming foundational to business continuity.

-

Governance & Reputation: Regulatory missteps can now land directly on the desks—or reputations—of boards and leaders.

-

Global Complexity: Fragmented, overlapping, and evolving mandates increase compliance costs and expose vulnerabilities.

-

Proactive Intelligence: AI-powered insights allow predictive compliance, mitigating violations before they happen.

Strategic Recommendations

-

Implement Real-Time Compliance Tools: Deploy dashboards, immutable data storage, and AI-enabled anomaly detection.

-

Elevate Compliance to the Boardroom: Engage executives through clear reporting, scenario planning, and accountability frameworks.

-

Normalize Third-Party Risk Monitoring: Use centralized platforms for vendor oversight, ESG assessments, and supply chain transparency.

-

Build AI Governance Models: Enforce transparency, bias oversight, and ethical decision-making in AI systems.

-

Stay Agile Amid Fragmentation: Map local regulations, automate policy changes, and nurture global compliance agility.

-

Analyze Enforcement Patterns: Track data breach settlements, FCA actions, and global fines (e.g., GDPR), and adjust control priorities.

Conclusion

Compliance in 2025 is no longer a static checkbox but a dynamic arena—where regulation, technology, board governance, and global strategy intersect. Organizations that embrace real-time readiness, leadership alignment, and digital intelligence will turn compliance from burden to business advantage.