PCI DSS 4.0 & DevSecOps: What Changed in 2025

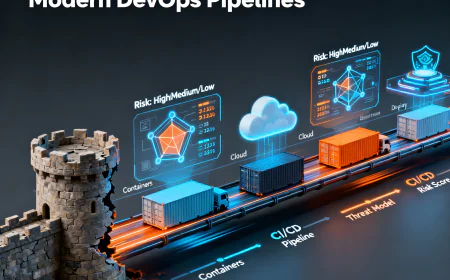

PCI DSS 4.0 finally went live in 2025, and it’s shaking up how payment security works in the age of DevSecOps. No more “tick-the-box” audits — the new standard demands continuous security, from secure coding to real-time API protection, automated testing in CI/CD pipelines, and even integrity checks on scripts running in browsers. For DevSecOps teams, this shift means weaving compliance into daily workflows, adopting SBOMs, and using automation to stay compliant and resilient — because in 2025, security isn’t just about passing an audit, it’s about surviving real-world threats.

Introduction

In 2025, PCI DSS 4.0 officially became the new standard for securing payment data — and it’s not just an upgrade, it’s a complete shift in how organizations need to think about compliance. For years, businesses treated PCI DSS like a yearly audit checklist: pass the test, get certified, and move on. But with 4.0, that mindset no longer works. The new version forces companies to build continuous, risk-based security into their DevSecOps pipelines, directly impacting how apps, APIs, and payment systems are developed and deployed.

Let’s break down what changed, why it matters, and how DevSecOps teams can adapt.

1. From Audit-Driven to Continuous Security

The old way: Organizations would prep for annual PCI DSS audits, fix issues just before the auditor arrived, and then relax until the next cycle.

The new reality: PCI DSS 4.0 requires continuous monitoring and testing — meaning vulnerabilities, access controls, and security practices must be active all year, not just during audit season.

For DevSecOps teams, this translates to:

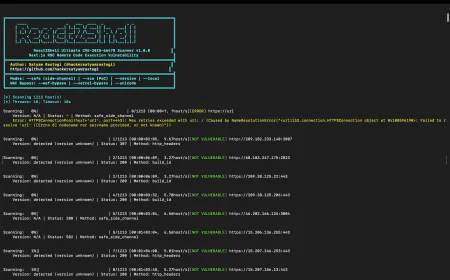

- Integrating vulnerability scans into CI/CD pipelines.

- Running automated penetration tests after each release.

- Using monitoring tools to track compliance status in real time.

2. Stricter Application and API Security

With more businesses moving to cloud-native architectures and exposing APIs, PCI DSS 4.0 now emphasizes secure software development practices:

- Stronger requirements for protecting APIs.

- Mandatory code reviews and automated testing.

- Enforcement of SBOMs (Software Bill of Materials) to track third-party components.

Real-world problem: Many payment systems in 2024 were breached through exposed or unprotected APIs. With 4.0, companies can no longer ignore API hardening — DevSecOps pipelines must test APIs the same way they test applications.

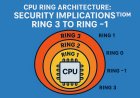

3. Browser Script Integrity for Payment Pages

One of the biggest new requirements is payment page script integrity checks. Hackers often inject malicious JavaScript into checkout pages (a common attack called Magecart), stealing cardholder data before it even hits the backend.

PCI DSS 4.0 now forces businesses to:

- Validate the integrity of all scripts on payment pages.

- Ensure only authorized scripts run in the browser.

- Monitor for any unexpected changes in real time.

For DevSecOps, this means adding script integrity scanning into deployment pipelines and setting up monitoring tools for front-end code.

4. Customized Approach = More Flexibility, More Responsibility

Earlier PCI versions were rigid: either meet the control exactly as written or fail compliance. PCI DSS 4.0 introduces a “customized approach” — allowing organizations to design equivalent security controls if they meet the intent of the requirement.

Pro: Companies get flexibility to use modern security tools (like AI-based monitoring).

Con: DevSecOps teams must document, test, and prove that their custom approach works — which means more accountability.

5. Stronger Developer & Security Training

PCI DSS 4.0 recognizes that technology alone isn’t enough — developers need better security awareness. Teams handling payment systems now require ongoing training in secure coding, API protection, and cloud security practices.

DevSecOps leaders need to integrate training into sprint cycles and make sure developers can identify vulnerabilities before code is pushed.

6. How DevSecOps Teams Can Adapt in 2025

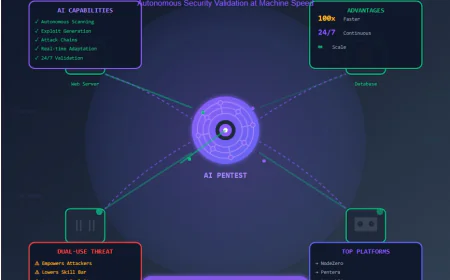

- Shift Left Security → Integrate static code analysis (SAST) and dependency scans early in the dev cycle.

- Automate Compliance → Map PCI DSS controls into CI/CD pipelines with automated checks.

- Continuous Testing → Run DAST (Dynamic Application Security Testing) and API fuzzing as part of release cycles.

- SBOM Adoption → Maintain an up-to-date inventory of all open-source and third-party libraries.

- Real-Time Monitoring → Use dashboards that track both system health and compliance status.

Conclusion

PCI DSS 4.0 is more than a compliance update — it’s a wake-up call for how organizations handle payment security in a world of APIs, cloud-native apps, and constant cyber threats. By embedding compliance into DevSecOps workflows, teams can move beyond “passing the audit” to building truly resilient payment ecosystems.

In 2025, PCI DSS 4.0 isn’t about paperwork. It’s about survival.